Is the Housing Market Going to Crash?

The current state of the housing market is a hot topic of debate. Some say that now is a buyers’ market, while others claim that prices are still too high.

The market is strong. Home prices are rising, and there is still a high demand for homes. This is due to several factors, including low-interest rates and a strong economy.

Some believe that a housing market crash is coming. However, there are several reasons why this is unlikely to happen.

The Current State of the Housing Market

Many factors can affect the housing market, from interest rates to job security. And, of course, there’s the ever-present question of supply and demand. In some parts of the country, more houses are on the market than buyers. This can lead to lower prices and more negotiation power for buyers. But in other parts of the country, the opposite is true, and sellers have the upper hand.

Housing Price Increases

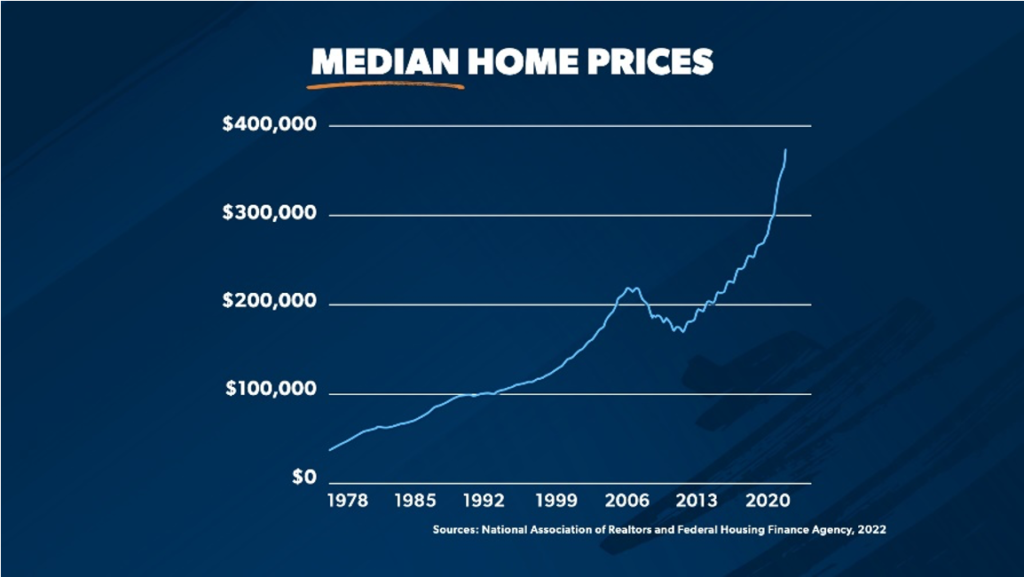

It’s no secret that house prices have been on the rise in recent years. For example, in 2020, prices increased by 29%, and in 2019 they increased by 18%.2 What’s behind this sharp increase?

For one thing, people are coming out of their collective quarantine caves and diving into the housing market like never before. With interest rates at record lows, now is a great time to buy a home, and many people are taking advantage of that fact. As a result, demand for homes is skyrocketing, driving prices up.

Prices are still projected to increase by 8% in 2021, And in 2023, they’re expected to increase by 3-4%. This may not seem like much compared to the past few years, but it’s pretty healthy. The average increase for residential single-family homes over the last 50 years has been 3-4%. So we’re finally returning to normal after a period of wild fluctuation.

Supply vs. Demand

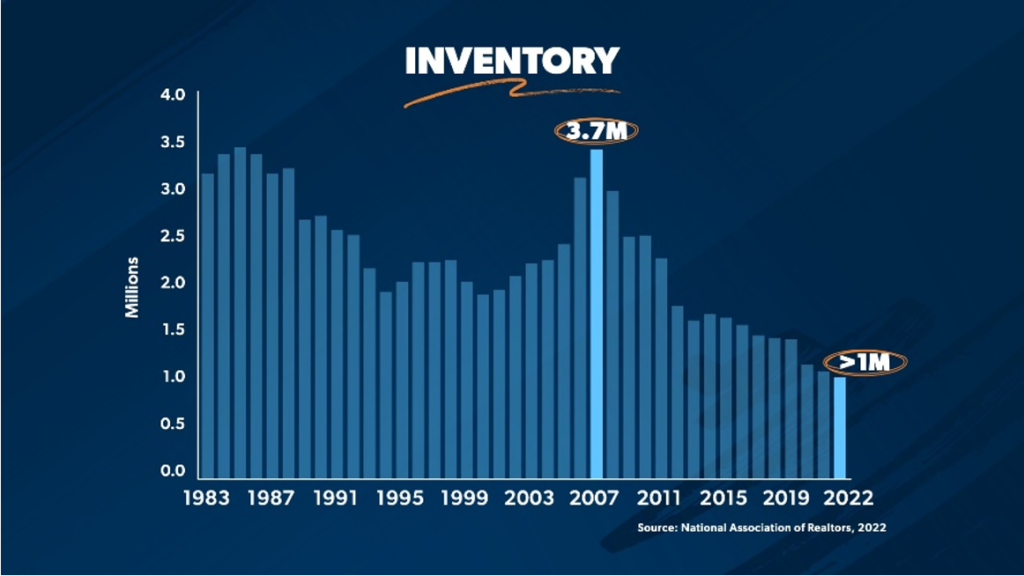

You’ve probably heard people say that housing prices are so high because of “supply and demand.” And they’re not wrong! It is simple when more people are looking to buy homes than there are homes available for sale, the prices for those homes go up. But, conversely, prices go down when there are more homes on the market than buyers.

Here in the US, we’ve been dealing with a shortage of homes for sale for about the last two decades. At the same time, the population has been growing, and more people are looking to buy homes than ever before. So it’s no surprise that prices have been skyrocketing as a result! In many cases, people have been willing to pay well above the appraised value of a home to get their hands on one.

This has caused even people not originally planning on selling their homes to be drawn into the market. After all, it’s hard to resist when you can get way more money for your home than you ever could have imagined! Today, there is still a higher demand for homes than there are homes available.

Supply Chain Issues

During the pandemic, there were supply chain issues everywhere. This put a hold on new homes due to factory shutdowns and lumber shortages. As a result, lumber prices nearly tripled during this time. It since then has normalized. However, the scarcity caused significant delays in building homes and has contributed to the higher costs.

Frozen Foreclosures

During the pandemic, the government put a freeze (moratorium) on foreclosures. Banks stopped foreclosures, letting people live in homes without making payments for nearly two years. We are now seeing foreclosures again. However, not enough to make up for the housing shortage.

Millennials

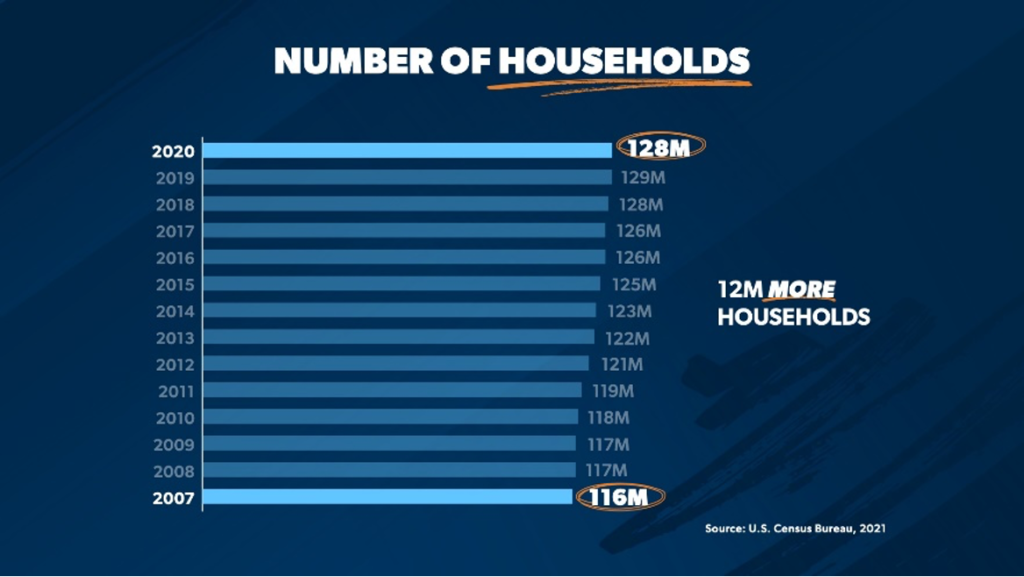

Millennials have entered the market. There are now 5 million more people in their mid-thirties than in 2006. In 2007 there were 116 million households. Now, there are 12 million more. So now more people are looking to buy than what is available.

Investors

Investors have bought up 28% of the homes for sale in Q1 of 2022, according to Harvard Joint Center for Housing. Unlike in 2007/2008, institutional investors buy single-family homes left and right, in desirable cities.

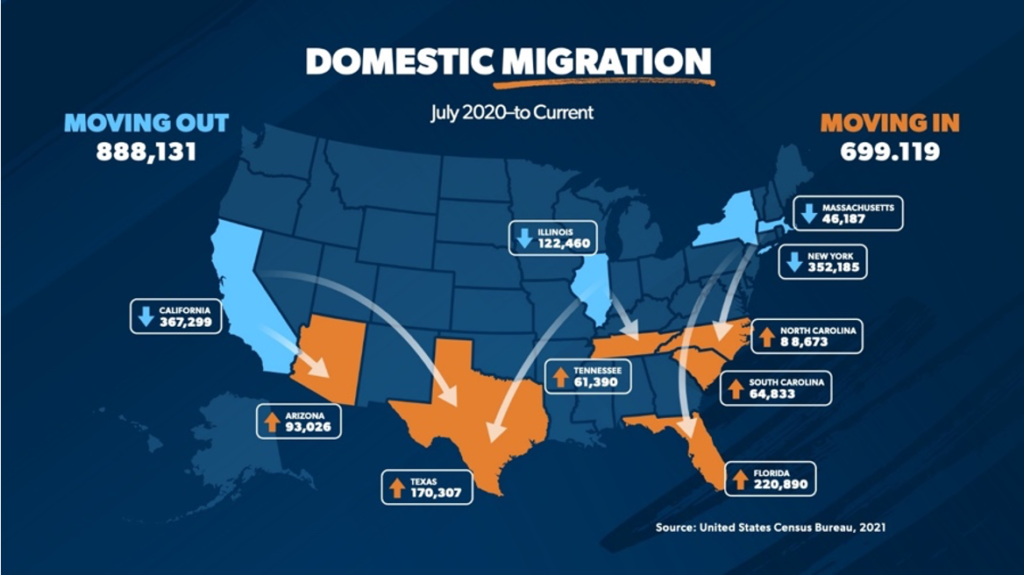

The Great Migration

Politics, taxes, and crime ratings drive large numbers of people to move across the states. Tennessee is one of the top states people have moved to, many moving from California and New York.

Interest Rates

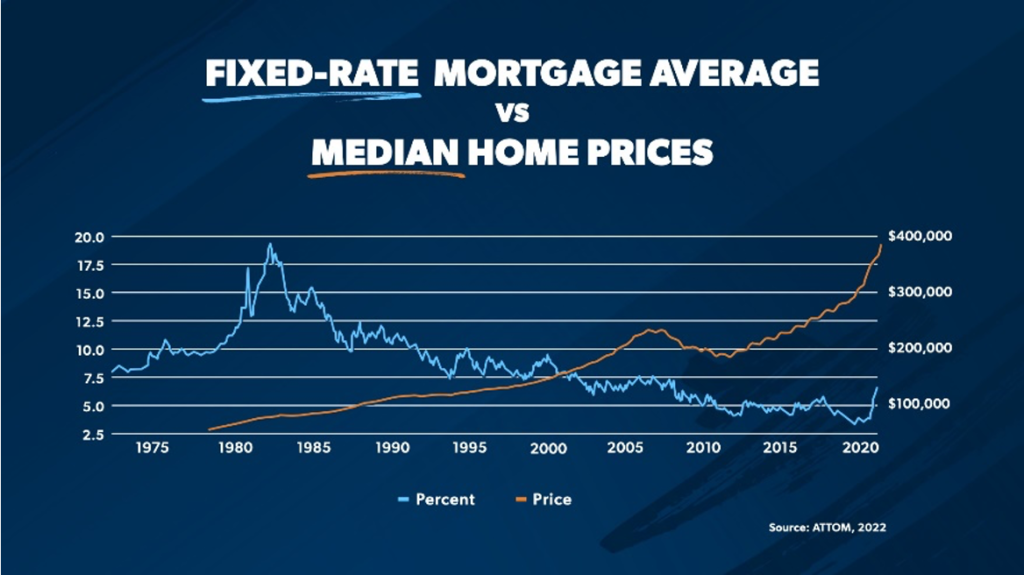

Even though interest rates may seem high compared to the last couple of years, they are still low and are beginning to normalize. For example, in the 1980’s interest rate almost rose to 20%.

Why The Market is Unlikely to Crash, Like in 2008 (Data)

So what does all this mean for you? If you’re considering buying a house, it’s essential to research and understand your area’s current market conditions. Talk to a real estate agent, get pre-approved for a mortgage, and be prepared to negotiate.